Introduction:

In the landscape of financial fraud in the United States, scams leveraging routing numbers and bank accounts have become increasingly prevalent. These schemes exploit vulnerabilities in the banking system, posing significant threats to individuals’ financial security and the integrity of financial institutions. This blog delves into the intricacies of scams in the USA that exploit routing numbers and bank accounts, shedding light on their various forms, modus operandi, and the steps individuals can take to protect themselves.

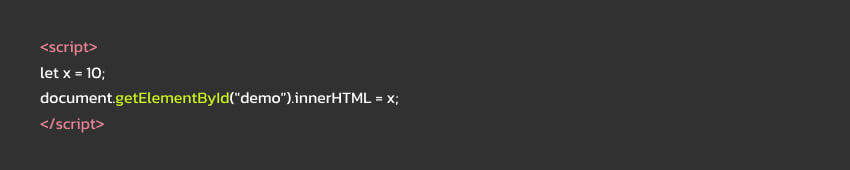

Understanding Routing Numbers:

Routing numbers, also known as ABA routing transit numbers, are nine-digit codes assigned to financial institutions by the American Bankers Association. They facilitate the routing of electronic transactions, such as direct deposits, wire transfers, and electronic bill payments, between banks and credit unions. Explore the structure and significance of routing numbers in the U.S. banking system and how they can be exploited by scammers.

Types of Scams Involving Routing Numbers and Bank Accounts:

Scammers employ various tactics to exploit routing numbers and bank accounts for illicit purposes. Explore the different types of scams prevalent in the USA, including:

Fake Check Scams: Fraudsters use counterfeit checks with legitimate routing numbers to deceive victims into depositing the funds and sending a portion back to the scammer.

Direct Deposit Scams: Scammers obtain individuals’ bank account information, including routing numbers, to initiate unauthorized direct deposits and steal funds.

Phishing Scams: Scammers trick individuals into divulging their bank account information, including routing numbers, through deceptive emails, texts, or phone calls.

Account Takeover Fraud: Cybercriminals gain unauthorized access to individuals’ bank accounts, often through phishing or malware attacks, and exploit their routing numbers to conduct fraudulent transactions.

Red Flags and Warning Signs:

Recognizing the warning signs of scams involving routing numbers and bank accounts is crucial for safeguarding against financial fraud. Learn to identify common red flags, such as:

Unsolicited requests for banking information via email, text, or phone.

Offers that sound too good to be true, such as lottery winnings or job opportunities requiring upfront payments.

Requests to deposit a check and send a portion of the funds elsewhere.

Unexpected changes to account activity or transactions.

Impact on Victims:

Falling victim to a scam involving routing numbers and bank accounts can have devastating consequences for individuals’ financial well-being and peace of mind. Explore the far-reaching impact of these scams, including financial loss, damaged credit, emotional distress, and legal repercussions. Hear firsthand accounts from victims who have experienced the fallout of falling prey to financial fraud.

Protecting Yourself Against Scams:

Empowering yourself with knowledge and adopting proactive measures is essential for protecting against scams involving routing numbers and bank accounts. Discover practical tips and best practices for safeguarding your financial information, including:

- Never share sensitive banking information with unknown or unverified individuals or entities.

- Verify the legitimacy of requests for banking information before providing any personal or financial details.

- Monitor your bank account activity regularly for any unauthorized transactions or suspicious activity.

- Educate yourself about common scams and stay informed about emerging threats in the financial fraud landscape.

Reporting and Seeking Assistance:

In the unfortunate event that you become a victim of a scam involving routing numbers and bank accounts, it’s essential to take prompt action to report the incident and seek assistance. Explore the reporting mechanisms available to victims, including:

- Contacting your bank or credit union to report unauthorized transactions and request assistance.

- Filing a complaint with the Federal Trade Commission (FTC) or the Consumer Financial Protection Bureau (CFPB) to document the scam and alert authorities.

- Seeking assistance from local law enforcement agencies or state consumer protection offices for further investigation and support.

Conclusion:

Scams involving routing numbers and bank accounts represent a significant threat to individuals’ financial security and trust in the banking system. By understanding the tactics employed by scammers, recognizing warning signs, and taking proactive steps to protect themselves, individuals can mitigate their risk exposure and safeguard their financial well-being. Together, we can raise awareness about these scams and work towards creating a safer and more secure banking environment for all.

2 Replies to “Exposed: Scams in the USA Exploiting Routing Numbers and Bank Accounts”

delania terrasse

March 16, 2024

delania terrasse

cassiopia artyomov

March 25, 2024

cassiopia artyomov